Renewables have come a long way over the last decade with consistently falling cost of manufacturing leading in turn to increasing penetration into national energy markets due to a combination of subsidies and their near zero marginal cost to produce energy. Which is all good right? All we have to do is make the grid more flexible/resilient and add more renewables until we’re done. Right? Well no, not so fast, as it turns out near zero marginal cost when coupled with intermittent supply is not always our friend.1

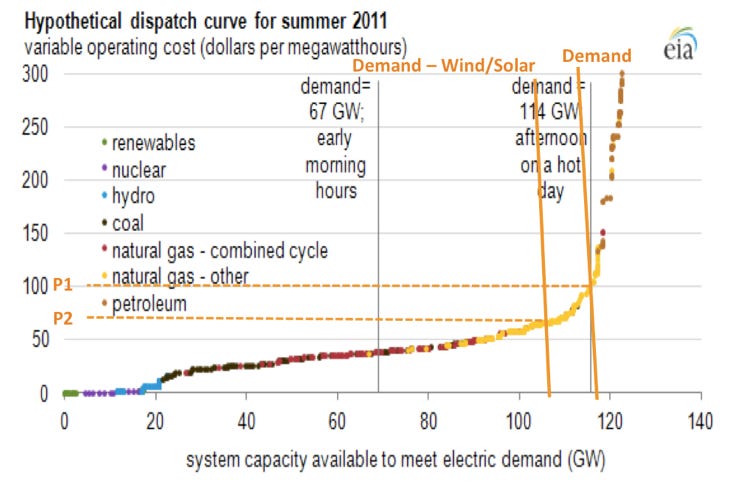

So let’s clap our Econ-101 hats on more firmly and have a closer look at how increasing renewables plays out in the market. In market theory price is determined by two factors the supply of some good and the demand for that good, more supply at same demand the price drops, more demand with the same supply the price rises. Now if you have more than one supplier in the market it turns out that the cheaper supplier sets the market ‘price’ as buyers vote with their pocket books, who’d have thought. All this is basic economic theory, and yes it applies to energy markets as to any other. So what happens when a supplier enters the market with a very cheap supply? The simple answer is that everyone who can, buys their energy product (in this case wind/solar) and this reduces the net demand for power (i.e. Net Demand = Demand - Wind/solar). As the net demand decreases so the clearing price also decreases because there’s less nett demand from customers.2 This is know as the merit-order effect and the diagram below (from Trembath and Jenkins 2015 article) illustrates this with wind/solar supply driving the clearing price down from P1 to P2 on the demand curve.

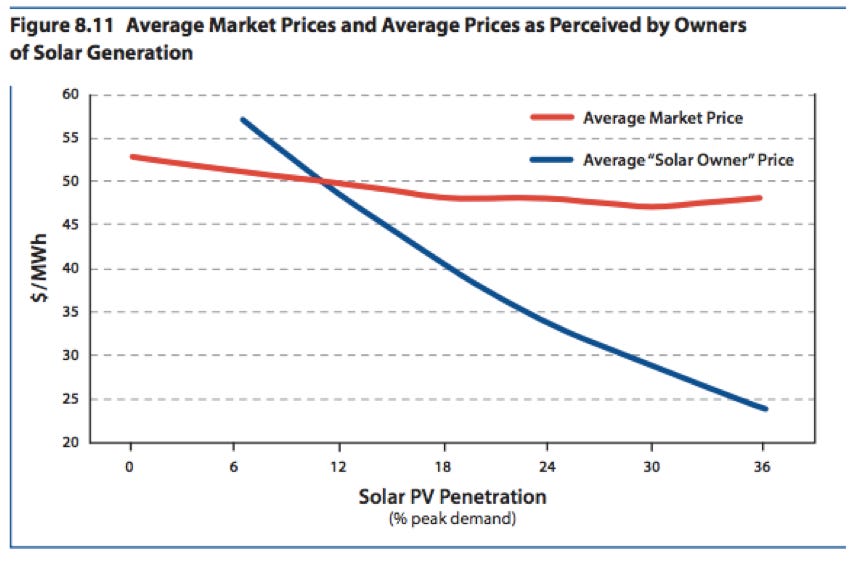

Because renewables are intermittent or bursty they also tend to produce lots of power at the same time so more supply of near zero marginal cost energy at these times depresses the clearing price even further. And as the penetration of renewables increases so to does the depression of market prices with the market saturated with supply at some times. Nor is this is a theoretical concept, the effect has been seen in the German energy market with a 2013 study finding that the value of wind power fell from 110% of the average power price to 50–80% as wind penetration increases from zero to 30% of total electricity consumption. For solar power, similarly low value levels are reached at 15% penetration. While all suppliers (generators) are affected by reducing market prices it’s the renewables that take the worst hit because their supply, and over-supply, tends to correlate even across large areas.3

Over time this crowding effect reduces the value factor for renewables, that is the ratio between the market price for renewables and the average market price. Again this is a real effect as the figure above derived from the Texas energy market illustrates. We can reasonably expect in Australia that as we add more renewables to the Australian Energy Market (AEM) the value factor of renewables will continue to fall and we will reach a point at which the investments don’t add up, and there will be no more entrants into the market. To date, to some extent, this value factor drop has been hidden by the overall reduction in the Levelised Cost Of Enegery (LCOE) so that new generators can still shave costs off and are willing to enter the market and compete. Unfortunately LCoE will not decrease for ever. Also unfortunately more efficient generators tend to drive out less competitive renewable generators, which is not ideal when you’re trying to increase the percentage of renewable generation in the face of increasing electrical demand.

This is a really big problem for us as we also need to overbuild supply (e.g. 120%) to achieve our network availability targets. So what to do about it? In the AEM one of the things we have (inadvertently) been doing about it is subsiding renewables via the national Renewable Energy Target (RET) scheme in which fossil fuel generators subsidise renewable generators.4 Likewise local state schemes also seek to incentivise renewable entrants into the energy market. The major problem with the RET approach is that the RET winds down to zero by 2030, which is, according to the federal government just when we will be approaching 82% renewable penetration.5 So my prediction here is that as we get closer to the 2030 wind down of the RET you’ll see some other form of permanent government subsidy put in place to ensure that new suppliers are willing to enter the market.6 Of course all else being equal that subsidy will need to increase as renewable penetration increases.

Rather than permanent funding is there any other way to end run this problem? Well storage can help to some extent. We can either add storage to renewables or we add independent storage, like Snowy 2.0. Adding organic storage to wind/solar farms can help but the downside is that it adds to the LCoE, and while wind farms can push excess power into Snowy 2.0 the Snowy Scheme is under no obligation to take the power at anything other than the clearing price. So yes storage will help, but not a whole lot.7 Inter-state exports of power, for example from high penetration states such as South Australia to low penetration states such as Victoria can also offset the rank merit effect, as it also does in Europe, but once all the states come up to the same level of renewable penetration there’ll be nowhere to export `to’. Finally we can link together renewables across sufficient distances that their power output decorrelates, for Australia north to south that’s about 1200 km or the distance from Brisbane to Melbourne.8 In comparison east-west Melbourne to Adelaide is around 654 km so wind systems are still correlated. Linking the states along the longest axes (Qld to SA or Qld to Vic) will reduce output capacity below the national nameplate value but smooth out the supply. All of that interconnecting requires infrastructure of course, which costs more.

Back in 2013 Alex Trembath and Jesse Jenkins suggested the following rough rule of thumb, “that it is increasingly difficult for the market share of variable renewable energy sources at the system-wide level to exceed the Capacity Factor (CF) of the energy source”. While you can go above this factor to do so requires significant financial and/or technological support. From this perspective when South Australia claims a renewable penetration of 60% we should remember that this is a generation bubble inflated by the RET cross subsidy and sustained by the export of power to lower penetration states and public/private investment in storage. Sure it’s not impossible to go above the CF factor threshold, rather it’s a point where the cost of doing so starts to inflect and increase rapidly. All of which possibly explains why, with only 2 GW of new wind farms in the pipeline, the Victorian Government is now proposing to publicly fund the construction of renewable generation.

Jenkins and Trembath’s rule of thumb also has significant implications for the mix of renewables that we choose to adopt, for if we include solar with an inherently lower capacity factor it will tend to displace wind but for only half the capacity. So including solar into the renewables mix we reduce the overall renewables capacity factor, in effect cannibalising that which is available for wind which has a higher ability to supply energy. The optimum strategy as it turns out is to preference renewables with the highest capacity factor, e.g offshore wind over onshore wind and onshore wind over solar.9 Unfortunately neither the AEMO nor the various State and Federal governments seem to be aware of this.

Finally we need to consider the cost of renewables themselves. While it would be nice to think that the cost of renewables will drop the increasing demand for the raw materials that go to make up solar PVs, batteries and wind turbines will undoubtedly increase the price of these in the short to medium term and our long honeymoon with renewables may be drawing to a close. The effect of ‘more expensive’ renewables would in turn deter new entrants to the market thereby requiring further subsidisation to make new entrants financially viable as projects. And unfortunately to achieve a significant overbuild that’s what we need to achieve.

As I’ve said before the energy transition is not going to be easy, cheap or done in a twinkle of an eye. Looking into my crystal ball of transition it predicts that as we head toward 2030 the looming retirement of the RET will damp down private investment in renewables while an unchecked investment in solar will continue to reduce the available percentage of generation available to us before we start getting into serious market price suppression. As renewable penetration is unevenly spread across the states we’ll also start to see these effects first in those states that have led with renewables as their ability to sell energy into other states reduces, looking at you South Australia. All of which will require/encourage market intervention either in the form of an ever increasing set of subsidies and/or the public funding of storage projects.10 In the end all of this will translate into either greater direct government spending or adding the costs onto energy bills. Will we then seriously think about alternatives? Or will the Sunk Cost fallacy once again have dominion over all?11

Marginal cost is the additional cost to produce more of something. Given that renewables do not consume resources to generate energy in the same way a fossil fuel plan burns fuel they have a near zero marginal cost.

Clearing price is simply the price you can sell your power at as a supplier.

Oversupply and market price depression also tends to drive base load fossil fuel suppliers out of the market as they have higher marginal rates and simply can’t compete at the lower prices.

Worth approximately AUD 9.3 billion to the industry.

Based on the various state targets for 2030.

The AEMO are already looking at paying for generating redundancy which is in effect a market subsidy.

The more significant problem with adding storage is that the energy required to be invested starts to exceed that which you get out of it. Weißbach et al. calculated that a return on energy invested of 7 to 1 was necessary to sustain a western technological society, which both solar and wind can (desert) solar can achieve alone. However once you add storage (even cheap pumped hydro) they both drop below that ROI of 7 to 1. That is they’re a net sink of energy due to the amount of energy you need to put in to build the infrastructure versus what you can extract.

We see this effect in the EU as well where the Great Britain to France Interconnect doesn’t really provide renewables backup as over those distance the wind is still correlated. See figure 12 of this article for details.

One of the reasons to consider geothermal power is that it has a high capacity factor, likewise extracting continuous power from ocean currents.

Cough, of course this is exactly what Snowy 2.0 is.

The capacity factor limit we've discussed is not the only constraint upon renewables and I'll discuss some of these in another post.

Very key point in the value collapse. I put it as "prices wI'll be zero or crazy"

A minor point, I don't think wind and solar interfere in the way you describe. Beiig somewhat anti-correlated, the build put of wind and solar should be able to get close to, but not quite upto their combined CF for the same level of value reduction.

Would also be interesting to see how correlated on and offshore wind are. Having a mix may be better than just one type.